Cold wallets have emerged as the fortress of digital asset protection, allowing individuals to retain control of their private keys offline. Yet, the complexities lie not only in the security mechanisms but also in ensuring that these cold wallets are compatible with the diverse array of cryptocurrencies that populate the market. By delving into the significance, challenges, strategies, and future trends, we uncover the evolving landscape of integrating cold wallets with various cryptocurrencies, ultimately empowering individuals to make informed decisions about securing their digital wealth.

Factors Influencing Cold Wallet Compatibility

Cryptographic Algorithms and Standards:

Cryptocurrencies rely on cryptographic algorithms to secure transactions and private keys. The choice of algorithm varies among cryptocurrencies, and this directly impacts cold wallet compatibility. Different algorithms, such as RSA, ECC, and SHA-256, require specific encryption methods and key structures. Wallet developers must align their encryption protocols with those supported by the target cryptocurrency to ensure seamless compatibility.

Blockchain Technologies:

Each blockchain has unique characteristics and protocols that affect cold wallet integration. Bitcoin and Ethereum, for instance, have distinct transaction validation methods and address structures. Cold wallets need to adapt to these differences to interact effectively with the respective blockchains. Compatibility hinges on the wallet’s ability to create, sign, and broadcast transactions in line with the blockchain’s requirements.

Token Standards:

The rise of tokenization has led to diverse token standards like ERC-20, BEP-2, and more. Cold wallets must support these standards to store and manage various tokens. Compatibility involves incorporating the logic for interacting with different tokens within the wallet’s framework. This includes handling token transfers, approvals, and other specific functionalities.

Multi-currency Support and Challenges:

Cold wallets aiming for multi-currency support encounter challenges due to the varying technical specifications of each cryptocurrency. Ensuring compatibility across multiple blockchains, algorithms, and token standards demands sophisticated design and meticulous testing. Additionally, maintaining security while supporting numerous currencies is a continual challenge that wallet developers must address.

Cold Wallets and Major Cryptocurrencies

Bitcoin (BTC):

- Bitcoin’s address formats and compatibility are crucial factors for cold wallet integration. The Segregated Witness (SegWit) upgrade introduced different address types (legacy, SegWit, native SegWit), which impacts wallet compatibility.

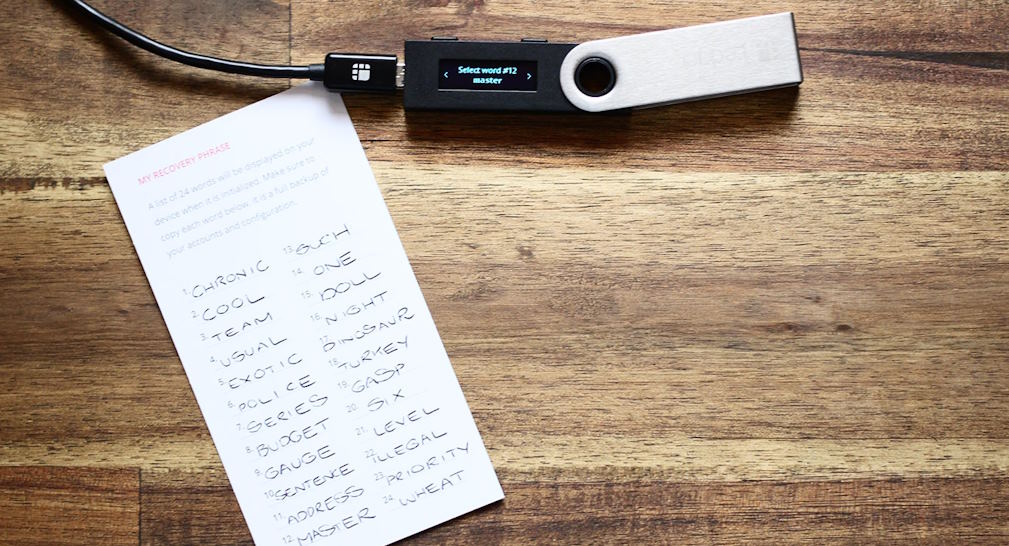

- Prominent cold wallet providers like Ledger and Trezor have tailored their solutions to support Bitcoin’s various address formats, ensuring users can securely store their BTC offline.

Ethereum (ETH):

- Cold wallet compatibility extends beyond ETH to encompass the broad spectrum of ERC-20 tokens. Cold wallets must be capable of accommodating these tokens, adhering to Ethereum’s token standards.

- Smart contract interactions pose a challenge for cold wallets due to their offline nature. Specialized solutions have emerged to facilitate secure signing and execution of smart contracts while maintaining the wallet’s isolation.

Ripple (XRP):

- Ripple’s unique architecture requires specific considerations for cold storage. XRP doesn’t rely on traditional blockchain technology, impacting how cold wallets interact with it.

- Wallet options like the Ledger Nano X have integrated XRP support, allowing users to store this cryptocurrency securely offline.

Litecoin (LTC):

- Litecoin shares similarities with Bitcoin, but compatibility issues arise due to different address formats. The adoption of SegWit and the introduction of the M- and L-addresses add complexity.

- Multi-currency wallets like Exodus and Coinomi offer compatibility with LTC alongside other cryptocurrencies, streamlining the experience for users holding diverse assets.

Additional Examples:

Other major cryptocurrencies such as Bitcoin Cash (BCH), Cardano (ADA), and Polkadot (DOT) each present their own compatibility challenges. For BCH, the fork from Bitcoin introduces nuances. ADA’s integration involves considering its unique staking and governance mechanisms. DOT’s presence on its own blockchain necessitates specialized cold wallet support.